Form W-8BEN Explained

An IRS Form W-8BEN form is a Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding and Reporting purposes. By completing a Form W-8BEN, you confirm to us that you are not a U.S. Taxpayer and you will avoid having taxes withheld from your interest payments.

Form W-8BEN is mandatory for all foreign customers who hold an account with BB Americas Bank. Each account holder (authorized signers on the account) must provide to the Bank an individual completed, dated and signed Form W-8BEN. It is the sole responsibility of the account holder(s) listed in the account(s) to complete Form W-8BEN correctly.

You may refer to the instructions below prepared by BB Americas Bank or visit the IRS website for more information.

- Form W-8BEN (Blank)

- BB Americas Instructions for Completing Form W-8BEN

- IRS Instructions for Completing Form W-8BEN

Additional Information:

Validity of Form W-8BEN: Form W-8BEN is valid for 3 years as of the date of signature on the form. The form expires on December 31 of the third year. BB Americas Bank will send you a notification via email or mail requesting the completion and return of a new Form W-8BEN when the most recent form on file nears expiry.

Why it is necessary to update Form W-8BEN every 3 years: Completing a new Form W-8BEN every 3 years is necessary to prove that your condition as a non-taxpayer in the U.S. remains in effect and, thus, to avoid the withholding of taxes on interest earnings.

Responsibility of updating and submitting Form W-8BEN: Updating and returning Form W-8BEN prior to the expiration date is the sole responsibility of the account holder(s) listed on the account(s). If an updated Form W-8BEN is not provided to BB Americas Bank, the Bank, acting in accordance with the IRS regulations, must begin withholding taxes.

Submission of the Form: After completing and signing Form W-8BEN, you must submit it to BB Americas Bank via your Online Banking access.

Where to send the form:

Please submit updated Form W-8BEN completed, dated and signed via Personal Online Banking or mail. Learn how:

Personal Online Banking

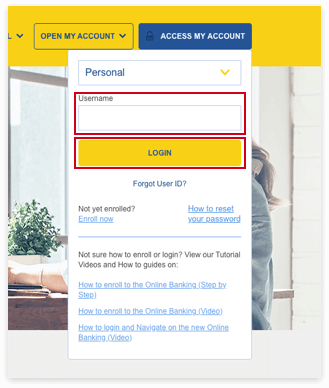

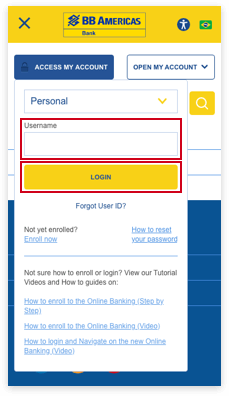

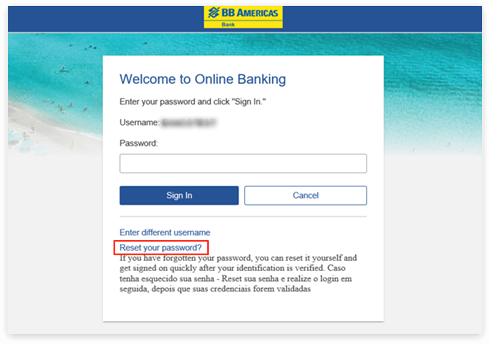

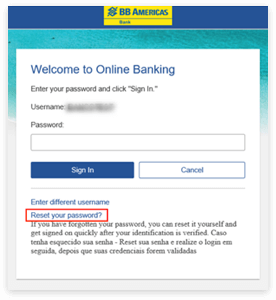

Log in to your Personal Online Banking Account:

- Visit our website, login. Under the Tools and Services option, select Messages & Requests.

- Select the Service Requests tab, then Transfer File.

- Click on File Transfer.

- Select Attach File to upload the desired document. Type a Description and select Submit.

- Keep track of your uploaded files under the File Upload History.

OR

Mailing address:

BB Americas Bank

ATTN: Operations Department

1221 Brickell Ave Suite 2200 – Miami, FL 33131