Privacy Policy

| FACTS | WHAT DOES BANCO DO BRASIL AMERICAS DO WITH YOUR PERSONAL INFORMATION? |

|---|---|

| Why? | Financial companies choose how they share your personal information. Federal law gives consumers the right to limit some but not all sharing. Federal law also requires us to tell you how we collect, share, and protect your personal information. Please read this notice carefully to understand what we do. |

| What? | The types of personal information we collect and share depend on the product or service you have with us. This information can include:

|

| How? | All financial companies need to share clients’ personal information to run their everyday business. In the section below, we list the reasons financial companies can share their clients’ personal information; the reasons Banco do Brasil Americas chooses to share; and whether you can limit this sharing. |

| Reasons we can share your personal information | Does Banco do Brasil Americas share? | Can you limit this sharing |

|---|---|---|

| For our everyday business purposes – such as to process your transactions, maintain your account(s), respond to court orders and legal investigations, or report to credit bureaus |

Yes | No |

| For our marketing purposes – to offer our products and services to you |

Yes | No |

| For joint marketing with other financial companies | No | We don’t share |

| For our affiliates’ everyday business purposes – information about your transactions and experiences |

Yes | No |

| For our affiliates’ everyday business purposes – information about your creditworthiness |

Yes | Yes |

| For our affiliates to market to you | Yes | Yes |

| For nonaffiliates to market to you | No | We don’t share |

To limit our sharing

- Mail the form below

Please note:

If you are a new client, we can begin sharing your information 30 days from the date we sent this notice. When you are no longer our client, we continue to share your information as described in this notice.

However, you can contact us at any time to limit our sharing.

Questions?

Call 855-377-2555

What We Do

| How does Banco do Brasil Americas protect my personal information? | To protect your personal information from unauthorized access and use, we use security measures that comply with federal law. These measures include computer safeguards and secured files and buildings. We also maintain physical, electronic and procedural safeguards that comply with federal standards to protect your nonpublic personal information. |

| How does Banco do Brasil Americas collect my personal information? | We collect your personal information, for example, when you

We also collect your personal information from others, such as credit bureaus, affiliates, or other companies. |

| Why can’t I limit all sharing? | Federal law gives you the right to limit only

State laws and individual companies may give you additional rights to limit sharing. See below for more on your rights under state law. |

| What happens when I limit sharing for an account I hold jointly with someone else? | Your choices will apply to everyone on your account. |

Definitions

| Affiliates | Companies related by common ownership or control. They can be financial and non-financial companies.

Our affiliates include:

|

| Nonaffiliates | Companies not related by common ownership or control. They can be financial and non-financial companies.

|

| Joint Marketing | A formal agreement between nonaffiliated financial companies that together market financial products or services to you.

State laws and individual companies may give you additional rights to limit sharing. See below for more on your rights under state law. |

Other Important Information

For Alaska, Illinois, Maryland and North Dakota Clients

We will not share personal information with nonaffiliates either for them to market to you or for joint marketing – without your authorization.

For California Clients

We will not share personal information with nonaffiliates either for them to market to you or for joint marketing – without your authorization. We will also limit our sharing of personal information about you with our affiliates to comply with all California privacy laws that apply to us.

For Massachusetts, Mississippi and New Jersey Clients.

We will not share personal information from deposit or share relationships with nonaffiliates either for them to market to you or for joint marketing – without your authorization

For Vermont Clients.

We will not share personal information with nonaffiliates for them to market to you without your authorization and we will not share personal information with affiliates or for joint marketing about your creditworthiness without your authorization.

LGPD Privacy Notice

PRIVACY STATEMENT-BRAZIL

This Privacy Notice for users located in Brazil supplements the information contained in the BB Americas Bank Privacy Policy and applies solely to visitors, users and others who reside in Brazil (“consumers” or “you”). We adopt this notice to comply with the Brazilian Data Protection Law Lei Geral de Proteção de Dados Pessoais (Law No. 13,709/2018) (“LGPD”). Any terms defined in the LGPD have the same meaning when used in this notice.

LGPD

On September 18, 2020, the Lei Geral de Proteção de Dados Pessoais (LGPD) came into effect for Brazilian residents. In addition to the rights outlined in our Privacy Policy, as a user located in Brazil, you may be able to exercise the following rights with respect to your personal information that we have collected, subject to certain limitations:

- The right to confirmation of the existence of the processing. You have the right to ask that we confirm whether we process your personal data.

- The right to access the data. You have the right to access the personal data we hold about you and certain information about how we use it and who we share it with, including information about any public and private entities we have shared your personal data with.

- The right to correct incomplete, inaccurate, or out-of-date data. If you want to correct or revise any of the data we retain on you, you may do so by accessing your account and the information contained within it.

- The right to anonymize, block, or delete unnecessary or excessive data or data that is not being processed in compliance with the LGPD. Please note that, depending on the request, this may result in a suspension or discontinuation of certain services and may be governed by legal and/or contractual retention guidelines.

- The right to the portability of data to another service or product provider, by means of an express request. We provide you with the ability to move any of your account data to a third party, at any time.

- The right to delete personal data processed with the consent of the data subject. You have a right to request the permanent deletion of your data, subject to certain exceptions. However, please note that exercising this right may result in a suspension or discontinuation of services and may also be governed by legal and/or contractual retention guidelines.

- The right to information about the possibility of not giving consent and about the consequences of the refusal. You have the right to ask us to provide information about the possibility of not giving consent for the processing of your personal data and the consequences of such refusal. (Consent is not needed, BB Americas does not share personal information other than with it is affiliate (BBSA in Brazil).

- The right to revoke consent.

Please note that not all of these rights listed above are absolute, and limitations/exceptions apply in some cases. For example, we may not be able to fully comply with your request if we are bound by certain legal restrictions or contractual requirements, but in those circumstances, we will still respond to notify you of such a decision.

Additionally, BB Americas Bank under the mandate of US Privacy Law does not share personal information with anyone other than the bank’s affiliate (BBSA in Brazil). Based on this, consent is not needed under the LGPD.

Exercising Data Portability and Deletion Rights

To exercise the data portability and deletion rights described above, please submit a verifiable consumer request to us by using the privacyinquiries@bbamericas.com

We will need to verify your identity before processing your request. The verifiable consumer request must:

- Provide sufficient information that allows us to reasonably verify you are the person about whom we collected personal information or a legal representative.

- Describe your request with sufficient detail that allows us to properly understand, evaluate and respond to it.

We cannot respond to your request or provide you with personal information if we cannot verify your identity or authority to make the request and confirm the personal information relates to you. Making a verifiable consumer request does not require you to create an account with us. We will only use personal information provided in a verifiable consumer request to verify the requestor’s identity or authority to make the request.

Response Timing and Format

We endeavor to respond to a verifiable consumer request within 15 days of its receipt but no more than 30 days. If you have an account with us, we will deliver our written response to that account. If you do not have an account with us, we will deliver our written response by mail or electronically, at your option. The response we provide will also explain the reasons we cannot comply with a request, if applicable. For data portability requests, we will select a format to provide your personal information that is readily useable and should allow you to transmit the information from one entity to another entity without hindrance.

We do not charge a fee to process or respond to your verifiable consumer request.

If you have provided data to BB Americas Bank regarding a client of yours, which is subject to the LGPD, you are responsible for obtaining the proper consent from such client prior to sharing their personal information with us.

Changes to Our Privacy Notice

We reserve the right to amend this privacy notice at our discretion and at any time.

When we make changes to this privacy notice, we will notify you by email or through a notice on our website homepage.

Contact Information

If you have any questions or comments about this notice, our Privacy Policy, the ways in which we collect and use your personal information, your choices, and rights regarding such use, or wish to exercise your rights under Brazilian law, please do not hesitate to contact us at:

Website: https://www.bbamericas.com/en/

Email: privacyinquiries@bbamericas.com

Postal Address: 1221 BRICKELL AVENUE, SUITE 2200

MIAMI, FL 33131

Cookies Policy

This policy explains how cookies are used on this website and other websites that link to this page and are made available by BB Americas Bank. This policy may be amended or updated from time to time to reflect changes in our practices or changes in applicable law. We encourage you to read this policy carefully and regularly check this page to review any changes we may make. By using this site, you agree to BB Americas Bank use of cookies on your device in accordance with the terms of this policy. If you do not wish to accept cookies from this site, please either disable cookies or refrain from using this site.

- What are Cookies?

A cookie is a small text-only file of information that is sent or transferred to your device (such as your computer, smartphone, or other web-enabled device) when you access a website. Cookies allow the website to recognize your device when you revisit and remember certain information about your prior visit such as which pages you visited, choices you made from menus, any specific information you entered into forms and the time and date of your visit. Among other things, cookies help us evaluate what parts of our websites are useful and which need improvement. - What Types of Cookies Do We Use?

The main types of cookies we use on our websites are:- Strictly Necessary cookies allow the technical operation of our websites or apps (e.g., cookies that enable you to navigate a website or app, and to use its features). Some may also increase the usability of our websites or apps by remembering your choices. You may be able to disable some or all necessary cookies by adjusting your browser settings. If you choose to do so, however, you may experience reduced functionality or be prevented from using our websites or apps altogether.

- Performance cookies help us enhance the performance and usability of our websites or apps. If you choose not to accept these cookies, you may experience less than optimal performance.

- Analytics cookies help us ensure that we understand our audience as clearly as possible, and that any information that is provided to you is as relevant as possible to your interests and preferences.

- Marketing cookies help us evaluate the effectiveness of our marketing campaigns or to provide better targeting for marketing. These cookies may collect personal data such as your name as well as information about how you interact with our websites, apps, or marketing materials.

- Cookies and Personal Data

Some of our cookies may collect and store your personal data, such as your name, email address or IP address. We are committed to respecting and protecting your privacy and will ensure that personal data we collect is kept and treated in accordance with our privacy policy. For further details of how we process personal data, please refer to the LGPD Privacy Policy under disclosures on our website. - Your Rights to Disable or Refuse Cookies on this Site

Most browsers are initially set to accept cookies. However, you typically have the ability to disable cookies if you wish by changing your internet software browsing settings. To manage your use of cookies there are various resources available to you. For example, the ‘Help’ section on your browser may assist you. You can also disable or delete the stored data used by technology similar to cookies, such as Local Shared Objects or Flash cookies, by managing your browser’s ‘add-on settings’ or visiting the website of its manufacturer.

Website Terms & Conditions

PLEASE READ THIS DOCUMENT CAREFULLY BEFORE ACCESSING OR USING THIS WEBSITE. THESE TERMS GOVERN THE USE OF THIS WEBSITE. IF YOU DO NOT AGREE WITH THESE TERMS DO NOT ACCESS THE WEBSITE. BY ACCESSING THE WEBSITE OR ANY OF ITS PAGES YOU AGREE TO BE BOUND BY THESE TERMS OF USE.

This website has been established by BB Americas Bank for the sole purpose of conveying information about the BB Americas Bank products and services and to allow communication between BB Americas Bank and its clients or visitors to the website. Information that appears on this website should be considered an advertisement. Nothing contained in any page on this site takes the place of the BB Americas Bank agreements and disclosures that govern its products and services. If any information on the site conflicts with that in BB Americas Bank agreements and disclosures, the agreements and disclosures will take precedence.

BB Americas Bank, at any time may place links to other websites on this page and you assume all responsibility when you go to other sites via the links on our pages. BB Americas Bank has no control over any other websites and is not responsible for the content on any other site other than this one.

The information and materials contained in this website are owned by BB Americas Bank or by others, as applicable. No material may be copied, displayed, transmitted, distributed, framed, sold, stored for use, downloaded, or otherwise reproduced except as permitted by law.

BB Americas Bank makes no warranties of any kind regarding the products and services advertised on this site. BB Americas Bank will use reasonable efforts to ensure that all information displayed is accurate; however, BB Americas Bank expressly disclaims any representation and warranty, whether expressed or implied, including, without limitation, warranties of merchantability, fitness for a particular purpose, suitability and the ability to use the site without contracting a computer virus. BB Americas Bank is not responsible for any loss, damage, expense, or penalty (either in tort, contract, or otherwise), including direct, indirect, consequential and incidental damages, that result from the access of or use of this site.

This limitation includes, but is not limited to the omission of information, the failure of equipment, the delay or inability to receive or transmit information, the delay or inability to print information, the transmission of any computer virus, or the transmission of any other malicious or disabling code or procedure. This limitation applies even if BB Americas Bank has been informed of the possibility of such loss or damage.

This agreement may be changed from time to time by posting the new Terms and Conditions on the website. All clients and visitors of this website agree to be subject to this agreement as it changes from time to time. This agreement and the use of this website are governed by the laws of the State of Florida, and the United States of America.

BB Americas Bank Website Supported Browsers

Supported Browser for BB Americas Bank website:

- Microsoft Edge (40 or higher)

- Firefox (53 or higher)

- Google Chrome (58 or higher and mobile)

- Safari (11 or higher and mobile)

BB Americas Bank strongly recommends the use of an updated version of the browser of your choice that is supported by our website.

When you use an updated browser version, the better your experience will be throughout our website. More functionalities will work properly and it also means that you will have a browser version equipped with the latest security parameters made available while navigating the Bank’s website.

Please note that BB Americas Bank provides support for all major browsers when accessing our website however, it is no longer providing support for Internet Explorer 11.

And what does this means for you?

If you access the BB Americas Bank website while using Internet Explorer 11, some functionalities may not work properly and you might experience some minor appearance issues. As an alternative for the use of the browser, Internet Explorer 11, the browser, Microsoft Edge, is available on Windows 10 version.

Business - Online Banking Agreement and Disclosure

This Online Banking Agreement and Disclosure (“Agreement”) governs the use of our Online Banking Services (“Online Services”) and serves as the agreement between you and BB Americas Bank. It is important that you read and understand the terms and conditions provided in this Agreement before you accept its terms. Your use of Online Services constitutes your acceptance and agreement to the terms and conditions of this Agreement as well as any other terms made available to you using Online Services. Additionally, your use of any Online Services that we introduce in the future constitutes an acknowledgment and agreement to the terms and conditions associated with those Online Services. Any agreements, amendments, notices, periodic statements, and other communications may be provided to you in electronic format if you have authorized that format of delivery. If you have any questions about this Agreement, contact us prior to acceptance.

DEFINITIONS

1.1 The terms “you,” “your,” “authorized user,” and “account owner” refer to the account owner, authorized signers, or individuals authorized by the account owner to access Online Services. The terms “we,” “us,” and “our” refer to BB Americas Bank, the financial institution.

1.2 “Account” refers to your account(s) with us that you have designated for Online Services access and that we allow to be included u under these Online Services. The type(s) of account that may be designated for Online Services include Business deposit accounts, such as Checking, Savings, NOW, Loan, Money Market, and Certificate accounts. You must be an account owner/authorized signer for each account that you designate and each account must permit withdrawal by a single signer.

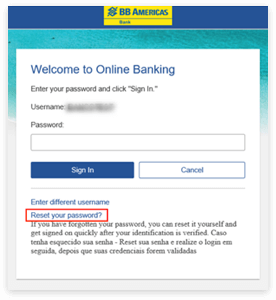

1.3 “Login Credentials” refers to your username and password that must be used to securely access your account information.

1.4 “Disclosures” refer to any regulatory disclosures provided to you at the time of depository account opening, such as the Truth in Savings Disclosure, Funds Availability Disclosure, Electronic Fund Transfer Disclosure, Privacy Disclosure, Substitute Check Policy Disclosure, as well as any Fee Schedule.

1.5 “Business Day” refers to the financial institution’s hours of operation for the purpose of conducting banking business: Monday through Friday, excluding federal holidays.

1.6 “Check Image” refers to the digital image of any check you transmit to us using Remote Deposit Capture.

1.7 “Item” refers to the definition provided in Article 4 of the Uniform Commercial Code: an instrument of a promise or order to pay money handled by a bank for collection or payment. The term does not include a payment order governed by Article 4A or a credit or debit card slip.

1.8 “Check” refers to the definition provided in Regulation CC – Availability of Funds and Collection of Checks: (1) a negotiable demand draft drawn on or payable through or at an office of a bank; (2) a negotiable demand draft drawn on a Federal Reserve Bank or a Federal Home Loan Bank; (3) a negotiable demand draft drawn on the Treasury of the United States; (4) a demand draft drawn on a state government or unit of general local government that is not payable through or at a bank; (5) a United States Postal Service money order; or (6) a traveler’s check drawn on or payable through or at a bank. The term check includes an original check and a substitute check.

1.9 “Original Check” refers to the definition provided in Regulation CC – Availability of Funds and Collection of Checks: the first paper check issued with respect to a particular payment transaction.

1.10 “Substitute Check” refers to the definition provided in Regulation CC – Availability of Funds and Collection of Checks: a paper reproduction of an original check that – (I) contains an image of the front and back of the original check; (2) bears a MICR line that, except as provided under ANS X9. I 00-140, contains all the information appearing on the MICR line of the original check at the time that the original check was issued and any additional information that was encoded on the original check’s MICR line before an image of the original check was captured; (3) conforms in paper stock, dimension, and otherwise with ANS X9. I 00-140; and (4) is suitable for automated processing in the same manner as the original check.

1.11 “Record” refers to a writing created, generated, sent, communicated, received, or stored by electronic means.

SYSTEM REQUIREMENTS. Online Services provides you with the convenience and flexibility to perform certain banking transactions and functions for designated Account(s) through internet access on your personal computer or via a wireless handheld device. You must meet the following minimum software and hardware requirements for each device you use to access Online Services:

Supported Browsers and Operating Systems

Business Online Banking is compatible with the following browsers and operating systems:

| Browser |

Microsoft Windows 10 | Apple® macOS® |

Google® Android™ | Apple iOS |

| Microsoft Edge |

X

|

|||

| Google Chrome™ |

X

|

X

|

X

|

X

|

| Mozilla® Firefox® |

X

|

|||

| Apple Safari® |

X

|

X

|

Supported browser and operating systems can operate on desktop, tablet, and smartphones. Content is sized and displayed based on the screen resolution and other display attributes of the device.

Note: Apple Safari cannot be used with a signature pad or peripheral devices for Digital One Teller.

If you decide not to maintain such hardware and software, you may cancel Online Services at any time.

ACCOUNT ACCESS. You may access your Account(s) at BB Americas Bank website, www.bbamericas.com. We may also utilize identifying information to confirm your identity. Your Login Credentials are used to gain Online Services and should be kept confidential at all times. It is recommended that you change your Login Credentials through Online Services, or with the assistance of our Client Support Service, as allowed by our security requirements. There may be additional or optional security measures instituted by us to ensure the security of Online Services.

USE OF PERSONAL INFORMATION. If you open an account or obtain a product or service from us using our online or mobile services, we may record your personal information from a scan or a copy of your driver’s license or other personal identification card, or we may receive an image or make a copy of your driver’s license or other personal identification card. We may store or retain this information to the extent permitted by law.

ACCOUNT LIABILITY FOR UNAUTHORIZED ONLINE ACCOUNT USE. Subject to federal and state law and the terms and conditions of this Agreement, you are liable for any transaction or function performed using Online Services, whether made by yourself or someone authorized or someone unauthorized by you using your Login Credentials. You agree to take all reasonable measures to protect the security of your Login Credentials.

Please refer to the Consumer Liability section of your Electronic Fund Transfer Disclosure for our liability policy. As a precaution, we recommend that you do not send emails or other electronic messages containing confidential Account information. You agree to not leave any device unattended while logged into Online Services, and you should never share your Login Credentials with us or anyone else. You understand that we are entitled to act upon any instructions received under your Login Credentials; therefore, you agree to guard and protect your Login Credentials to ensure the security and protection of your Account(s).

If you have any concerns or suspicions that an unauthorized person has gained access to your Account through Online Services, we recommend that you change your Login Credentials if possible and notify us immediately. Our contact information for security issues related to your use of Online Services is provided below.

Address:

BB Americas Bank

Digital Channels

1221 Brickell Ave – Suite 2200, Miami FL, 33131

Phone:

1-855-377-2555 (USA), 0800-881-1448 (Brazil – other cities), 4003-1448 (Brazil – Major cities & capitals), (305)-350-1100 (Other Countries)

E-mail:

csc@bbamericas.com

TRANSACTIONS AND FUNCTIONS OF THE SERVICES. The transactions and functions available through Online Services may include, but are not limited to, the following:

- Transfer of funds between your Accounts.

- Transfer of funds between your own Accounts on a recurring basis.

- External account to your own account at another U.S. Financial Institution. Available options: one time and/or on a recurring basis.

*Service setup subject to prior analysis and approval by BB Americas Bank. - External account to unowned account at another Financial Institution. Available options: one time and/or on a recurring basis.

*Service setup subject to prior analysis and approval by BB Americas Bank. - Domestic and International Wire Transfers. Available options: one time and/or on a recurring basis.

- Balance inquiry on each Account.

- Request or retrieve a copy of a paid check, paid share draft, or past statement on the Account.

- Re-order checks for your Account(s), as applicable.

- Loan Payments.

- ACH Payments. *Service setup subject to prior analysis and approval by BB Americas Bank.

- Change the Account(s) and Access Information for Online Services.

- Change and update of Contact Information (Telephone and E-mail).

- Conduct secure email communication with us regarding Online Services.

- The use of our Bill Pay Services.

- The use of Remote Deposit Capture (“RDC”) services.

- The use of Mobile Banking services.

- Other: Other 1

The above transaction and function capabilities may be available, either all or in part, depending on the Account, customer type, or other Online Services limitations. We reserve the right to restrict the use of Online Services for any account type or to impose any other limitation or restriction on the use of Online Services.

TRANSACTION LIMITATIONS. The maximum dollar amount that we permit for

- External Transfer: A one-time and/or recurring transfer is $3,000.00 Daily Limit | $10,000.00 Monthly Limit.

- Wire Transfers: $75,000 for a one-time and/or recurring transfers.

We reserve the right to amend these limits and may refuse to process any transfer request that exceeds them.

ONLINE TRANSACTION FUNDING. In order for us to process an Online Services transfer request, the Account that you have designated for the debit must have sufficient funds to cover the transfer, including any overdraft protection plan coverage and the funds must be considered available as described in our Funds Availability Policy. Please refer to your Disclosures for any non-sufficient funds fee or other fee(s) that may be assessed. We are under no obligation to you when we have been unable to complete a transfer request due to insufficient or unavailable funds, or due to other circumstances out of our control, such as a system or power failure. If we are consistently unable to complete the requested transfer due to insufficient funds in the designated debit Account, then we reserve the right to cancel the transfer request and to review your Online Services privileges. If you have opted in to overdraft services, please refer to your account opening Disclosures for any overdraft services policies related to funding your accounts and any overdraft fees.

EFFECTIVE TIMING OF TRANSACTIONS. Online Services are available at any time or day, unless the system is undergoing maintenance. The posting of Online transactions before 4pm on a Business Day will post the same day and will be included in the available funds for the receiving Account. Transfers requested after 4pm on a Business Day or requested on a non-Business Day will post on the following Business Day to the receiving Account and will be considered available funds on that day.

The posting of Wire Transfer transactions (Domestic or International) before 2pm on a Business Day will post the same day and will be included in the available funds for the receiving Account. Transfers requested after 2pm on a Business Day or requested on a non-Business Day will post on the following Business Day to the receiving Account and will be considered available funds on that day.

CANCELING A TRANSFER. A one-time transfer is immediate and cannot be canceled. The deadline for canceling a recurring transfer request is 4 days prior to the effective date. If you have any questions or problems canceling the transfer, please contact us.

COST OF SERVICE. Account transaction fees as stated in any Disclosures and Fee Schedule provided to you remain in effect and are not eliminated or changed with the use of Online Services. You have sole responsibility for any service fees you incur from your telephone, internet, or wireless service providers. When signing up for Online Services, a separate schedule of fees and charges specific to these Online Services will be provided.

BILL PAY SERVICES. You can access Bill Pay Services in the same manner that you access other Online Services by using your Login Credentials and meeting any other security measures that we may institute. You must indicate the Account that is to be considered the designated Account to be debited for your bill-paying activities. If using a money market account or savings account, be aware that the number of transactions allowed is limited by federal regulation-see the Transaction Limitations provision of this Agreement. There is a $5.00 minimum and a $9,999.99 maximum dollar amount that is permitted for payments using our Bill Pay Services.

In order to pay bills, you will need to create a list of payees, providing the information required to log and submit your payments accurately. We require at least 30 days as set-up time for Checks and online payments through Bill Pay Services. If you fail to take into account our required set-up time and the payment is received by the payee after the due date, we are not responsible for any late charges or other actions that may be taken by the payee due to the late payment. Please make other payment arrangements for the payment that is due and set-up the next payment to that payee through Bill Pay Services.

We assume responsibility for all reasonable efforts to process your payments through Bill Pay Services in a timely and accurate manner. We accept no liability for any damages you may incur due to insufficient or unavailable funds in the designated Account that may adversely affect payment processing, any inaccuracies in the payee information supplied in regards to this payment, any mishandling or delay in posting by the payee or the payee’s financial institution of account, or any system or postal delays or interruptions or any other circumstances out of our control, to the extent allowed by state and federal law and the provisions of this Agreement. Also, contact us immediately if you suspect any security breach of your Login Credentials or any unauthorized activity using Bill Pay Service.

CANCELLING BILL PAY SERVICES. You may cancel Bill Pay Services at any time through the Online Baking or by contacting us via phone, or in any other form or manner acceptable to us. When not canceling in writing or in a Record to us, we may require a Record or writing confirming the Bill Pay Services cancelation. Be aware of any outstanding payments and make arrangements for future payments to the payees. When deleting specific payees only, you may individually delete that payee and retain the Bill Pay Services for any remaining payees.

REMOTE DEPOSIT CAPTURE (“RDC”). RDC services allow you to make deposits to your Account from remote locations by electronically transmitting digital images of your original paper checks, which are drawn on or payable through United States financial institutions in United States dollars to us. The Check Clearing for the 21st Century Act and Regulation CC govern the use of RDC services and have enabled financial institutions to accept Substitute Checks, which are the legal equivalent to Original Checks for all purposes.

RDC FEES AND CHARGES. Any and all fees and charges associated with your Accounts remain in effect when accessing and using RDC services. You understand that standard data charges and messaging rates imposed by your wireless service provider may apply and that these rates and charges are your sole responsibility. Please contact your service provider for additional information.

ELIGIBILITY OF ITEMS. You may only submit Items for deposit that are within the dollar limits established for you. We reserve the right to limit the dollar amount and frequency of deposits made through RDC services by you, and we may raise or lower your dollar limit in the future at our sole discretion at any time. You agree that we are not obligated to accept any Check Image that we determine to be ineligible and you agree to deposit only Checks as defined by section 1.8 in the DEFINITIONS section of this Agreement. You acknowledge that ineligible Items include, but are not limited to, the following: ACH payments or wire transfers, Items drawn on banks located outside of the United States, cash, illegible Items, incomplete Items, Items which are altered in any way, any Check that has previously been converted to a Substitute Check, any Item that contains indecipherable magnetic ink character recognition (“MICR”) data, any Check originally made payable to a party other than you and any stale or post-dated Items.

PROCESSING REQUIREMENTS. You agree you will not alter any Original Check or Check Image under any circumstance and you warrant that all Original Checks are authorized for the amount stated on the Check by the person who created the Check. At the time of presentment to you by drawer, any Checks that you initiate for deposit must contain all necessary information on the front and back of the Check, including all endorsements, the identity of the drawer and paying bank that is preprinted on the Check, and the image quality must be in compliance with the minimum requirements established by the American National Standards Institute (“ANSI”). Determination of image quality compliance is in our sole discretion and any Check may be rejected if it does not meet this criterion. You also agree that all Check Images you submit for deposit through RDC services will not contain any viruses or other potentially harmful attributes.

ACCEPTANCE OF ITEMS. We are not responsible for any Items, which we do not receive. Items received will each be reviewed for acceptability and any accepted Item will be converted into a Substitute Check. You agree that electronic conveyance of a Check does not equate to receipt of the Check. You agree that a notice confirming receipt of your deposit does not mean the Item is error-free or that it will not be rejected upon further review. If we do reject an Item for any reason, we will provide you with a notice of rejection; however, we will not be liable for loss suffered as a result of the rejected Item. We will also provide you with a notice if your deposited Item is dishonored, in which case you permit us to debit such amount from your account. You may confirm receipt of all deposited Items by viewing your account statements or by contacting us.

RETENTION AND DISPOSAL OF CHECKS. You agree to securely preserve and protect each Original Check for a period of 15 days and during this period you agree to provide any Original Check to us upon request. Once you have obtained confirmation from us that we have received an Item, you agree to indicate its presentment via electronic means directly on the Original Check. You agree you will not deposit or submit any Original Check, which you have already submitted or deposited electronically into an account you own with us or at any other financial institution. At the expiration of the 15-day period, you will destroy each Original Check in its entirety to ensure it is not presented for payment again. You understand that any misuse of a Check Image after presentment to us is your responsibility and you will be solely liable for any resulting loss.

MOBILE BANKING. Mobile Banking services refers to all financial services made available to you and which you may access through the use of a wireless handheld device or mobile phone, including but not limited to, viewing account balances, remote deposit capture, and text message banking.

ACCESSIBILITY AND LIABILITY. Our Mobile Banking services are designed to be available 24 hours each day, 7 days per week. We do not warrant that Mobile Banking services will always function properly or that disruption or suspension of Mobile Banking services will not occur. You agree that we will not be liable for any loss, costs, damages, or expenses resulting from the interruption of Mobile Banking services. You also agree that these Mobile Banking services are separate from any services provided by your wireless service provider. Your wireless provider is responsible for any issues involving your handheld device, your internet access, or any other of its services and products you use to access Mobile Banking services. Standard data and messaging rates, short message service (SMS) fees, and other charges from your wireless provider apply when utilizing Mobile Banking services.

MOBILE DEVICES. You are responsible for providing and maintaining your own wireless handheld device and for ensuring that it is compatible with Mobile Banking services. We are not responsible for any problems you may experience with your equipment or for any damage to your device from the use of Mobile Banking services. You understand that wireless devices may be subject to viruses, and we are not responsible for ensuring you r device is protected from these viruses.

TRANSACTION LIMITS. You acknowledge that we may limit the number and frequency of transactions conducted through Mobile Banking services and that we may also place limits on transaction and transfer amounts in our sole discretion.

YOUR LIABILITY. You are responsible for the activity performed through Online Services using your Login Credentials, including any activity performed by others who use your Login Credentials whether or not authorized by you. You also agree to review your Account activity online, through periodic statements or through the use of any other application. If you have any questions or concerns about any Online Services activity, you should contact us immediately.

You acknowledge that you do not own or have any proprietary rights to Online Services and any unauthorized reproduction in whole or in part is strictly prohibited. You agree not to use Online Services to conduct any activity that is illicit or illegal. You agree to comply with all applicable federal and state laws, NACHA Operating Rules, the terms and conditions of this Agreement, and any other Account Agreement or Disclosure by reference, in regards to these Online Services and any transaction or functions performed using these Online Services. In the event of a conflict between this Agreement and any other Disclosure or Agreement provided, the Account Agreement will take precedence over this Agreement.

OUR LIABILITY. We are responsible for taking all reasonable measures to ensure that Online Services are available and functioning optimally, reserving the right to temporarily remove Online Services from access for maintenance or upgrades. We also accept responsibility to process any function or transaction requested by you through Online Services in a timely manner when submitted within the terms and conditions of this Agreement.

The hardware and software specifications for these Online Services are located in the System Requirements section above. We accept no responsibility, and you agree to hold us harmless for any delay or inaccuracy of any transaction or function information due to an interruption or loss of communications in the service provided by your web browser, wireless provider, or your system hardware or software, to the extent allowed by state and federal law. We also accept no responsibility, and you agree to hold us harmless for any system virus or other system problem attributable to Online Services or to your internet or wireless service provider.

CANCELING SERVICE. You may cancel any or all of these Online Services at any time by contacting us at the contact information provided above. Upon cancelation, you agree to immediately discontinue any use of our Online Services, and you agree to remain liable for all transactions performed on your Accounts. We reserve the right to refuse your application for Online Services if your Accounts are not in good standing, and to suspend, restrict, or cancel your authorization to use Online Services at any time, at our discretion. We will take reasonable measures to reach you concerning the Online Service cancelation, but are under no obligation to provide you such notice. If Online Services are reinstated, this Agreement will remain in effect.

GOVERNING LAW. The terms and conditions of this Agreement are subject to and governed by the laws of the state in which the account was opened and federal law. The Accounts designated for access through Online Services continue to be governed under this Agreement and the Disclosures provided to you for each Account. We will notify you of any changes as required by law.

SEVERABILITY. Whenever possible, each provision of this Agreement shall be interpreted in such manner as to be effective and valid under applicable law. If any provision of this Agreement is found to be prohibited by or invalid under applicable law, such provision shall be ineffective only to the extent of such prohibition or invalidity, without invalidating the remainder of such provision or the remaining provisions of this Agreement.

ASSIGNABILITY. We may assign our rights and duties under this Agreement to an affiliate or successor. You may not assign your right and duties under this Agreement at any time.

NO WAIVER. You understand and agree that no delay or failure on our part to exercise any right, remedy, power, or privilege under this Agreement shall effect or preclude our future exercise of that right, remedy, power, or privilege.

ACKNOWLEDGMENT. By electronically accepting this agreement, you acknowledge that you have received, read, and understand the Online Banking Agreement and Disclosure and consent to all of the terms and conditions contained above.

Personal - Online Banking Agreement and Disclosure

This Online Banking Agreement and Disclosure (“Agreement”) governs the use of our Online Banking Services (“Online Services”) and serves as the agreement between you and BB Americas Bank. It is important that you read and understand the terms and conditions provided in this Agreement before you accept its terms. Your use of Online Services constitutes your acceptance and agreement to the terms and conditions of this Agreement as well as any other terms made available to you using Online Services. Additionally, your use of any Online Services that we introduce in the future constitutes an acknowledgment and agreement to the terms and conditions associated with those Online Services. Any agreements, amendments, notices, periodic statements, and other communications may be provided to you in electronic format if you have authorized that format of delivery. If you have any questions about this Agreement, contact us prior to acceptance.

DEFINITIONS

1.1 The terms “you,” “your,” “authorized user,” and “account owner” refer to the account owner, authorized signers, or individuals authorized by the account owner to access Online Services. The terms “we,” “us,” and “our” refer to BB Americas Bank, the financial institution.

1.2 “Account” refers to your account(s) with us that you have designated for Online Services access and that we allow to be included u under these Online Services. The type(s) of account that may be designated for Online Services include Consumer and Business deposit accounts, such as Checking, Savings, NOW, Loan, Money Market, and Certificate accounts. You must be an account owner/authorized signer for each account that you designate and each account must permit withdrawal by a single signer.

1.3 “Login Credentials” refers to your username and password that must be used to securely access your account information.

1.4 “Disclosures” refer to any regulatory disclosures provided to you at the time of depository account opening, such as the Truth in Savings Disclosure, Funds Availability Disclosure, Electronic Fund Transfer Disclosure, Privacy Disclosure, Substitute Check Policy Disclosure, as well as any Fee Schedule.

1.5 “Business Day” refers to the financial institution’s hours of operation for the purpose of conducting banking business: Monday through Friday, excluding federal holidays.

1.6 “Check Image” refers to the digital image of any check you transmit to us using Remote Deposit Capture.

1.7 “Item” refers to the definition provided in Article 4 of the Uniform Commercial Code: an instrument of a promise or order to pay money handled by a bank for collection or payment. The term does not include a payment order governed by Article 4A or a credit or debit card slip.

1.8 “Check” refers to the definition provided in Regulation CC – Availability of Funds and Collection of Checks: (1) a negotiable demand draft drawn on or payable through or at an office of a bank; (2) a negotiable demand draft drawn on a Federal Reserve Bank or a Federal Home Loan Bank; (3) a negotiable demand draft drawn on the Treasury of the United States; (4) a demand draft drawn on a state government or unit of general local government that is not payable through or at a bank; (5) a United States Postal Service money order; or (6) a traveler’s check drawn on or payable through or at a bank. The term check includes an original check and a substitute check.

1.9 “Original Check” refers to the definition provided in Regulation CC – Availability of Funds and Collection of Checks: the first paper check issued with respect to a particular payment transaction.

1.10 “Substitute Check” refers to the definition provided in Regulation CC – Availability of Funds and Collection of Checks: a paper reproduction of an original check that – (I) contains an image of the front and back of the original check; (2) bears a MICR line that, except as provided under ANS X9. I 00-140, contains all the information appearing on the MICR line of the original check at the time that the original check was issued and any additional information that was encoded on the original check’s MICR line before an image of the original check was captured; (3) conforms in paper stock, dimension, and otherwise with ANS X9. I 00-140; and (4) is suitable for automated processing in the same manner as the original check.

1.11 “Record” refers to a writing created, generated, sent, communicated, received, or stored by electronic means.

SYSTEM REQUIREMENTS. Online Services provides you with the convenience and flexibility to perform certain banking transactions and functions for designated Account(s) through internet access on your personal computer or via a wireless handheld device. You must meet the following minimum software and hardware requirements for each device you use to access Online Services:

Supported Browsers and Operating Systems

| Browser |

Microsoft Windows 10 | Apple® macOS® |

Google® Android™ | Apple iOS |

| Microsoft Edge |

X

|

|||

| Google Chrome™ |

X

|

X

|

X

|

X

|

| Mozilla® Firefox® |

X

|

|||

| Apple Safari® |

X

|

X

|

If you decide not to maintain such hardware and software, you may cancel Online Services at any time.

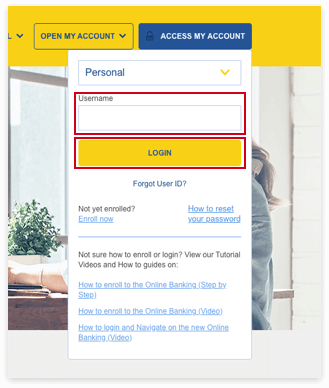

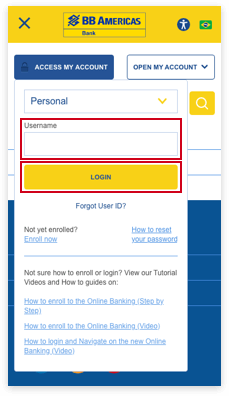

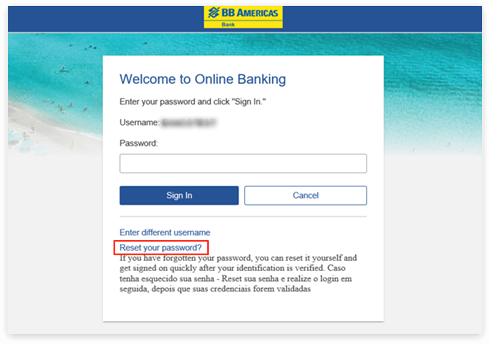

ACCOUNT ACCESS. You may access your Account(s) at BB Americas Bank website, www.bbamericas.com. You must follow necessary instructions and create your Login Credentials before gaining access to Online Services. We may also utilize identifying information to confirm your identity. Your Login Credentials are used to gain Online Services and should be kept confidential at all times. It is recommended that you change your Login Credentials through Online Services, or with the assistance of our Client Support Service, as allowed by our security requirements. There may be additional or optional security measures instituted by us to ensure the security of Online Services.

USE OF PERSONAL INFORMATION. If you open an account or obtain a product or service from us using our online or mobile services, we may record your personal information from a scan or a copy of your driver’s license or other personal identification card, or we may receive an image or make a copy of your driver’s license or other personal identification card. We may store or retain this information to the extent permitted by law.

ACCOUNT LIABILITY FOR UNAUTHORIZED ONLINE ACCOUNT USE. Subject to federal and state law and the terms and conditions of this Agreement, you are liable for any transaction or function performed using Online Services, whether made by yourself or someone authorized or someone unauthorized by you using your Login Credentials. You agree to take all reasonable measures to protect the security of your Login Credentials.

Please refer to the Consumer Liability section of your Electronic Fund Transfer Disclosure for our liability policy. As a precaution, we recommend that you do not send emails or other electronic messages containing confidential Account information. You agree to not leave any device unattended while logged into Online Services, and you should never share your Login Credentials with us or anyone else. You understand that we are entitled to act upon any instructions received under your Login Credentials; therefore, you agree to guard and protect your Login Credentials to ensure the security and protection of your Account(s).

If you have any concerns or suspicions that an unauthorized person has gained access to your Account through Online Services, we recommend that you change your Login Credentials, if possible and notify us immediately. Our contact information for security issues related to your use of Online Services is provided below.

Address:

BB Americas Bank

Digital Channels

1221 Brickell Ave – Suite 2200, Miami FL, 33131

Phone:

1-855-377-2555 (USA), 0800-881-1448 (Brazil – other cities), 4003-1448 (Brazil – Major cities & capitals), (305)-350-1100 (Other Countries)

E-mail:

csc@bbamericas.com

TRANSACTIONS AND FUNCTIONS OF THE SERVICES. The transactions and functions available through Online Services may include, but are not limited to, the following:

- Transfer of funds between your Accounts.

- Transfer of funds between your own Accounts on a recurring basis.

- External account to your own account at another U.S. Financial Institution. Available options: one time and/or on a recurring basis.

- External account to unowned account at another U.S. Financial Institution. Available options: one time and/or on a recurring basis.

- Domestic and International Wire Transfers. Available options: one time and/or on a recurring basis.

- Balance inquiry on each Account.

- Request or retrieve a copy of a paid check, paid share draft, or past statement on the Account.

- Re-order checks for your Account(s), as applicable.

- Loan Payments.

- ACH Payments.

- Change the Account(s) and Access Information for Online Services.

- Change and update of Contact Information (Telephone and E-mail).

- Conduct secure email communication with us regarding Online Services.

- The use of our Bill Pay Services.

- The use of Remote Deposit Capture (“RDC”) services.

- The use of Mobile Banking services.

- Other: Other 1

The above transaction and function capabilities may be available, either all or in part, depending on the Account, customer type, or other Online Services limitations. We reserve the right to restrict the use of Online Services for any account type or to impose any other limitation or restriction on the use of Online Services.

TRANSACTION LIMITATIONS. The maximum dollar amount that we permit for

- External Transfer: A one-time and/or recurring transfer is $3,000.00 Daily Limit | $10,000.00 Monthly Limit.

- Wire Transfers: No limit for a one-time and/or recurring transfers. Transactions above $50,000 will require an additional call back validation to be performed by the Bank.

We reserve the right to amend these limits and may refuse to process any transfer request that exceeds them.

ONLINE TRANSACTION FUNDING. In order for us to process an Online Services transfer request, the Account that you have designated for the debit must have sufficient funds to cover the transfer, including any overdraft protection plan coverage and the funds must be considered available as described in our Funds Availability Policy. Please refer to your Disclosures for any non-sufficient funds fee or other fee(s) that may be assessed. We are under no obligation to you when we have been unable to complete a transfer request due to insufficient or unavailable funds, or due to other circumstances out of our control, such as a system or power failure. If we are consistently unable to complete the requested transfer due to insufficient funds in the designated debit Account, then we reserve the right to cancel the transfer request and to review your Online Services privileges. If you have opted in to overdraft services, please refer to your account opening Disclosures for any overdraft services policies related to funding your accounts and any overdraft fees.

EFFECTIVE TIMING OF TRANSACTIONS. Online Services are available at any time or day, unless the system is undergoing maintenance. The posting of Online transactions before 4pm on a Business Day will post the same day and will be included in the available funds for the receiving Account. Transfers requested after 4pm on a Business Day or requested on a non-Business Day will post on the following Business Day to the receiving Account and will be considered available funds on that day.

The posting of Wire Transfer transactions (Domestic or International) before 2pm on a Business Day will post the same day and will be included in the available funds for the receiving Account. Transfers requested after 2pm on a Business Day or requested on a non-Business Day will post on the following Business Day to the receiving Account and will be considered available funds on that day.

CANCELING A TRANSFER. A one-time transfer is immediate and cannot be canceled. The deadline for canceling a recurring transfer request is 4 days prior to the effective date. If you have any questions or problems canceling the transfer, please contact us.

COST OF SERVICE. Account transaction fees as stated in any Disclosures and Fee Schedule provided to you remain in effect and are not eliminated or changed with the use of Online Services. You have sole responsibility for any service fees you incur from your telephone, internet, or wireless service providers. When signing up for Online Services, a separate schedule of fees and charges specific to these Online Services will be provided.

BILL PAY SERVICES. You can access Bill Pay Services in the same manner that you access other Online Services by using your Login Credentials and meeting any other security measures that we may institute. You must indicate the Account that is to be considered the designated Account to be debited for your bill-paying activities. If using a money market account or savings account, be aware that the number of transactions allowed is limited by federal regulation-see the Transaction Limitations provision of this Agreement. There is a $5.00 minimum and a $9,999.99 maximum dollar amount that is permitted for payments using our Bill Pay Services.

In order to pay bills, you will need to create a list of payees, providing the information required to log and submit your payments accurately. We require at least 30 days as set-up time for Checks and online payments through Bill Pay Services. If you fail to take into account our required set-up time and the payment is received by the payee after the due date, we are not responsible for any late charges or other actions that may be taken by the payee due to the late payment. Please make other payment arrangements for the payment that is due and set-up the next payment to that payee through Bill Pay Services.

We assume responsibility for all reasonable efforts to process your payments through Bill Pay Services in a timely and accurate manner. We accept no liability for any damages you may incur due to insufficient or unavailable funds in the designated Account that may adversely affect payment processing, any inaccuracies in the payee information supplied in regards to this payment, any mishandling or delay in posting by the payee or the payee’s financial institution of account, or any system or postal delays or interruptions or any other circumstances out of our control, to the extent allowed by state and federal law and the provisions of this Agreement. Contact us immediately if you suspect any security breach of your Login Credentials or any unauthorized activity using Bill Pay Service.

CANCELLING BILL PAY SERVICES. You may cancel Bill Pay Services at any time through the Online Baking or by contacting us via phone or in any other form or manner acceptable to us. When not canceling in writing or in a Record to us, we may require a Record or writing confirming the Bill Pay Services cancelation. Be aware of any outstanding payments and make arrangements for future payments to the payees. When deleting specific payees only, you may individually delete that payee and retain the Bill Pay Services for any remaining payees.

REMOTE DEPOSIT CAPTURE (“RDC”). RDC services allow you to make deposits to your Account from remote locations by electronically transmitting digital images of your original paper checks, which are drawn on or payable through United States financial institutions in United States dollars to us. The Check Clearing for the 21st Century Act and Regulation CC govern the use of RDC services and have enabled financial institutions to accept Substitute Checks, which are the legal equivalent to Original Checks for all purposes.

RDC FEES AND CHARGES. Any and all fees and charges associated with your Accounts remain in effect when accessing and using RDC services. You understand that standard data charges and messaging rates imposed by your wireless service provider may apply and that these rates and charges are your sole responsibility. Please contact your service provider for additional information.

ELIGIBILITY OF ITEMS. You may only submit Items for deposit that are within the dollar limits established for you. We reserve the right to limit the dollar amount and frequency of deposits made through RDC services by you, and we may raise or lower your dollar limit in the future at our sole discretion at any time. You agree that we are not obligated to accept any Check Image that we determine to be ineligible and you agree to deposit only Checks as defined by section 1.8 in the DEFINITIONS section of this Agreement. You acknowledge that ineligible Items include, but are not limited to, the following: ACH payments or wire transfers, Items drawn on banks located outside of the United States, cash, illegible Items, incomplete Items, Items which are altered in any way, any Check that has previously been converted to a Substitute Check, any Item that contains indecipherable magnetic ink character recognition (“MICR”) data, any Check originally made payable to a party other than you and any stale or post-dated Items.

PROCESSING REQUIREMENTS. You agree you will not alter any Original Check or Check Image under any circumstance and you warrant that all Original Checks are authorized for the amount stated on the Check by the person who created the Check. At the time of presentment to you by drawer, any Checks that you initiate for deposit must contain all necessary information on the front and back of the Check, including all endorsements, the identity of the drawer and paying bank that is preprinted on the Check, and the image quality must be in compliance with the minimum requirements established by the American National Standards Institute (“ANSI”). Determination of image quality compliance is in our sole discretion and any Check may be rejected if it does not meet this criterion. You also agree that all Check Images you submit for deposit through RDC services will not contain any viruses or other potentially harmful attributes.

ACCEPTANCE OF ITEMS. We are not responsible for any Items, which we do not receive. Items received will each be reviewed for acceptability and any accepted Item will be converted into a Substitute Check. You agree that electronic conveyance of a Check does not equate to receipt of the Check. You agree that a notice confirming receipt of your deposit does not mean the Item is error-free or that it will not be rejected upon further review. If we do reject an Item for any reason, we will provide you with a notice of rejection; however, we will not be liable for loss suffered as a result of the rejected Item. We will also provide you with a notice if your deposited Item is dishonored, in which case you permit us to debit such amount from your account. You may confirm receipt of all deposited Items by viewing your account statements or by contacting us.

RETENTION AND DISPOSAL OF CHECKS. You agree to securely preserve and protect each Original Check for a period of 15 days and during this period you agree to provide any Original Check to us upon request. Once you have obtained confirmation from us that we have received an Item, you agree to indicate its presentment via electronic means directly on the Original Check. You agree you will not deposit or submit any Original Check, which you have already submitted or deposited electronically into an account you own with us or at any other financial institution. At the expiration of the 15-day period, you will destroy each Original Check in its entirety to ensure it is not presented for payment again. You understand that any misuse of a Check Image after presentment to us is your responsibility and you will be solely liable for any resulting loss.

MOBILE BANKING. Mobile Banking services refers to all financial services made available to you and which you may access through the use of a wireless handheld device or mobile phone, including but not limited to, viewing account balances, remote deposit capture, and text message banking.

ACCESSIBILITY AND LIABILITY. Our Mobile Banking services are designed to be available 24 hours each day, 7 days per week. We do not warrant that Mobile Banking services will always function properly or that disruption or suspension of Mobile Banking services will not occur. You agree that we will not be liable for any loss, costs, damages, or expenses resulting from the interruption of Mobile Banking services. You also agree that these Mobile Banking services are separate from any services provided by your wireless service provider. Your wireless provider is responsible for any issues involving your handheld device, your internet access, or any other of its services and products you use to access Mobile Banking services. Standard data and messaging rates, short message service (SMS) fees, and other charges from your wireless provider apply when utilizing Mobile Banking services.

MOBILE DEVICES. You are responsible for providing and maintaining your own wireless handheld device and for ensuring that it is compatible with Mobile Banking services. We are not responsible for any problems you may experience with your equipment or for any damage to your device from the use of Mobile Banking services. You understand that wireless devices may be subject to viruses, and we are not responsible for ensuring your device is protected from these viruses.

TRANSACTION LIMITS. You acknowledge that we may limit the number and frequency of transactions conducted through Mobile Banking services and that we may also place limits on transaction and transfer amounts in our sole discretion.

YOUR LIABILITY. You are responsible for the activity performed through Online Services using your Login Credentials, including any activity performed by others who use your Login Credentials whether or not authorized by you. You also agree to review your Account activity online, through periodic statements or through the use of any other application. If you have any questions or concerns about any Online Services activity, you should contact us immediately.

You acknowledge that you do not own or have any proprietary rights to Online Services and any unauthorized reproduction in whole or in part is strictly prohibited. You agree not to use Online Services to conduct any activity that is illicit or illegal. You agree to comply with all applicable federal and state laws, NACHA Operating Rules, the terms and conditions of this Agreement, and any other Account Agreement or Disclosure by reference, in regards to these Online Services and any transaction or functions performed using these Online Services. In the event of a conflict between this Agreement and any other Disclosure or Agreement provided, the Account Agreement will take precedence over this Agreement.

OUR LIABILITY. We are responsible for taking all reasonable measures to ensure that Online Services are available and functioning optimally, reserving the right to temporarily remove Online Services from access for maintenance or upgrades. We also accept responsibility to process any function or transaction requested by you through Online Services in a timely manner when submitted within the terms and conditions of this Agreement.

The hardware and software specifications for these Online Services are located in the System Requirements section above. We accept no responsibility, and you agree to hold us harmless for any delay or inaccuracy of any transaction or function information due to an interruption or loss of communications in the service provided by your web browser, wireless provider, or your system hardware or software, to the extent allowed by state and federal law. We also accept no responsibility, and you agree to hold us harmless for any system virus or other system problem attributable to Online Services or to your internet or wireless service provider.

CANCELING SERVICE. You may cancel any or all of these Online Services at any time by contacting us at the contact information provided above. Upon cancelation, you agree to immediately discontinue any use of our Online Services, and you agree to remain liable for all transactions performed on your Accounts. We reserve the right to refuse your application for Online Services if your Accounts are not in good standing, and to suspend, restrict, or cancel your authorization to use Online Services at any time, at our discretion. We will take reasonable measures to reach you concerning the Online Service cancellation, but are under no obligation to provide you such notice. If Online Services are reinstated, this Agreement will remain in effect.

GOVERNING LAW. The terms and conditions of this Agreement are subject to and governed by the laws of the state in which the account was opened and federal law. The Accounts designated for access through Online Services continue to be governed under this Agreement and the Disclosures provided to you for each Account. We will notify you of any changes as required by law.

SEVERABILITY. Whenever possible, each provision of this Agreement shall be interpreted in such manner as to be effective and valid under applicable law. If any provision of this Agreement is found to be prohibited by or invalid under applicable law, such provision shall be ineffective only to the extent of such prohibition or invalidity, without invalidating the remainder of such provision or the remaining provisions of this Agreement.

ASSIGNABILITY. We may assign our rights and duties under this Agreement to an affiliate or successor. You may not assign your right and duties under this Agreement at any time.

NO WAIVER. You understand and agree that no delay or failure on our part to exercise any right, remedy, power, or privilege under this Agreement shall effect or preclude our future exercise of that right, remedy, power, or privilege.

ACKNOWLEDGMENT. By electronically accepting this agreement, you acknowledge that you have received, read, and understand the Online Banking Agreement and Disclosure and consent to all of the terms and conditions contained above.