Your journey starts with our Gold Global¹ Checking

Have convenient and safe access to your money, while simplifying your activities abroad, such as:

Shopping online

Leisure and traveling

Property maintenance

Education expenses

Family expenses

Medical treatment

Maximize your Investment by Diversifying your Funds

You can choose how much of your total investment amount goes towards interest-bearing accounts as well as your primary checking account.

E-Money Market²

Maximizing your earnings in a strong currency while keeping easy access to your money.

Go further with a Credit Card

Get a secured credit card⁴ along with your checking account and enjoy the benefits of having a Credit Card issued from the USA

0% APR for 12 months*

Earn 1 point per every $1 spent

No international fee while using the card within the USA

For product information, pricing and terms and conditions, click here.

Ready to Start? Here is what you will need:

Initial Deposit

Passport, ID or Driver License

Proof of Address

Banco do Brasil S.A. Bank Statement

Initial Deposit Details:

- $3,000 for BB S.A. Clients, CAPES/CNPq Scholars (Prepaid cardholders) and Employees of the BB S.A. Conglomerate.

- The total amount of the deposit can be distributed between your primary checking account and other products (Money Market, CD, Credit Card).

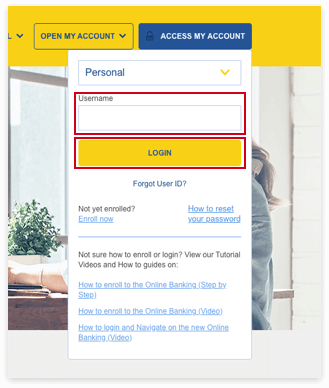

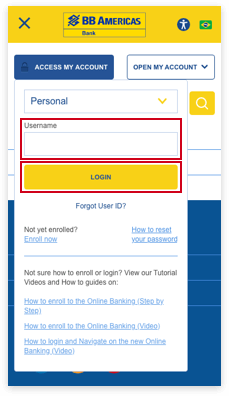

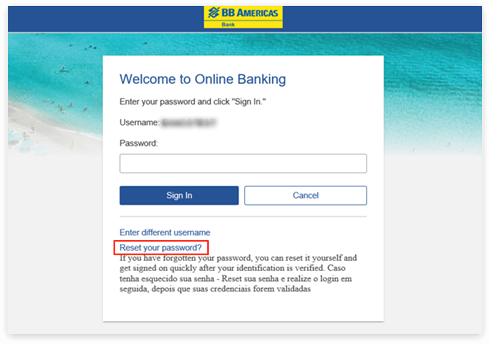

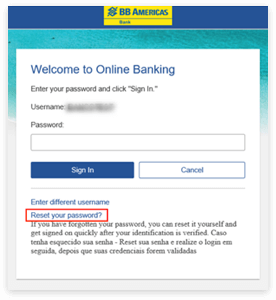

¹This account only offers e-statements. You must enroll in Online Banking within 30 days after the account is opened. This account does not offer access to some Online Banking tools (BILL PAY). Outgoing wire transfers can be conducted through the Online Banking. The initial deposit to fund the Gold Global account opened online for BB S.A. clients must come from the BB S.A. account of same ownership.

²This account account does not issue checks. This account only offers e-statements. You must enroll in Online Banking within 30 days after the account is opened. Debit card is not available for this account. Outgoing wire transfers can be conducted through our Online Banking. Wire transfers can only be sent from an e-Money Market account if you have an active account and signature card on file with the bank. Federal regulations limits the amount of transfers and point of sale transactions from this account to a maximum combined total of six (6) per month. The Bank will charge a fee of $15.00 per excessive debit transaction each month if the account exceeds six (6) covered debit transactions. Clients who continue to exceed these limits will be notified by the bank and the account will be closed or converted to a checking account. Your account may no longer earn interest.

³Fees could reduce the earnings on the account. A penalty may be imposed for early withdrawal. After the maturity of the CD, you have 10 calendar days to withdraw funds without penalty. After that time it will automatically renew. Online Banking and Mobile Banking services are available only with linked Checking or Money Market account.

⁴Certain terms, conditions and exclusions apply. Secured Credit Card applicants are required to open a Personal Secured Credit Card Checking Account or a 24-month CD and assign as collateral. The CD will automatically renew at the end of the 24 months.

*After that, your APR will be variable between 16.24% to 18.00% based on your creditworthiness when you open your account.